Budgets

Build trended or trending budgets in minutes or create complex model-based budgets.

To us it's simple...

"Do things the right way. For the right reasons. Good things will follow."

-2.png?width=528&height=408&name=Data%20Visualization%20(KPIs%2c%20Dashboards)-2.png)

KPIs, Profitability, & Pricing

Take control of your performance by defining sustainable growth levers and deep diving into problem areas.

ProNexus can help provide the tools and practices you need to save time, reduce errors, and promote collaboration across your organization, enabling you to:

ProNexus' financial analysts bring the technical and analytic expertise needed to design insightful and actionable reports while leveraging your current technology, if desired.

Reduce the added cost, complexity, and security risks of multiple solutions with an analytics platform that scales from individuals to the organization as a whole.

Find and share meaningful insights with hundreds of data visualizations, built-in AI capabilities, tight Excel integration, and pre-built custom data connectors.

Keep your data secure with industry-leading data security capabilities including sensitivity labeling, end-to-end encryption, and real-time access monitoring.

Build trended or trending budgets in minutes or create complex model-based budgets.

Build and adjust client forecasts based on actuals. Predict how the month or next 5 years will develop.

Automate budget vs actual and variance reports so you know exactly how you are doing at all times.

Instantly generate a variety of reports and automate into ready report packages for leadership and stakeholders.

Templated and customizable dashboards.

Use rolling forecasts with scenario analysis to help determine cash strategies.

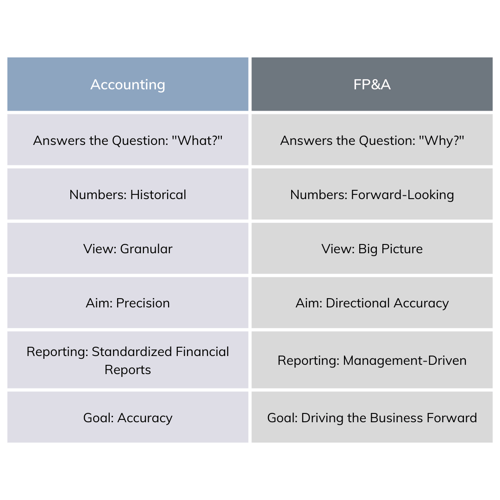

For cash-strapped startups and small businesses the temptation to simply add to their accountant’s workload is strong. However, this is not a wise decision. Simply put, an accountant handles the day-to-day financial activities for the business, while FP&A professionals are concerned with figuring out the meaning behind the numbers and are forward looking.

FP&A is the key for getting fast and accurate interpretation of financial data pulled from critical business systems. It provides the real time analysis that lets high-growth companies identify and implement appropriate strategic actions.

Forecasting is the process of making predictions based on past and present data. Later these can be compared against what happens. For example, a company might estimate their revenue in the next year, then compare it against the actual results.

Business analysis is a professional discipline of identifying business needs and determining solutions to business problems. Solutions often include a software-systems development component, but may also consist of process improvements, organizational change or strategic planning and policy development

The 13-week forecasting model is just short enough to be reliable because it lets you use historical data to estimate cash flow in the near term. But unlike short-term models – think weekly forecasting – the 13-week framework still provides a long-term view.

The most crucial ingredient of a good excel model is how user-friendly the excel model is. If you ask a stakeholder to look at it and try to understand, would they know what it’s all about? Your job is to create such user-friendly excel models that anyone can understand. If you need to do the error check regularly, you must do it to ensure that all the figures and calculations in the balance sheet in the cash flow statement are accurate.

Financial modeling is the process of estimating the financial performance of a project or business by considering all relevant factors, growth and risk assumptions, and interpreting their impact.

FP&A is crucial in setting and executing on strategic vision. By standardizing the entire FP&A process, ProNexus FP&A experts can turn information into knowledge, and knowledge into actionable insights. The result is real-time, in-depth financial analysis and simplified budgetary processes that drive business value.

You are finding you spend too much time gathering instead of analyzing data. Budgeting and forecasting processes are overly complex.

Few growth stage companies can be consistently profitable without careful financial planning and cash flow management. Unfortunately, this is often a weak link as the time available for staff to work on focused analysis is minimal.